Start by requesting a free copy of your credit report every year. Get to know your credit score and thoroughly review your credit report for any inaccurate information. If there are errors, request a deletion. If you need help in doing so, then consult a financial specialist experienced in the field of credit collection.

Start by requesting a free copy of your credit report every year. Get to know your credit score and thoroughly review your credit report for any inaccurate information. If there are errors, request a deletion. If you need help in doing so, then consult a financial specialist experienced in the field of credit collection.

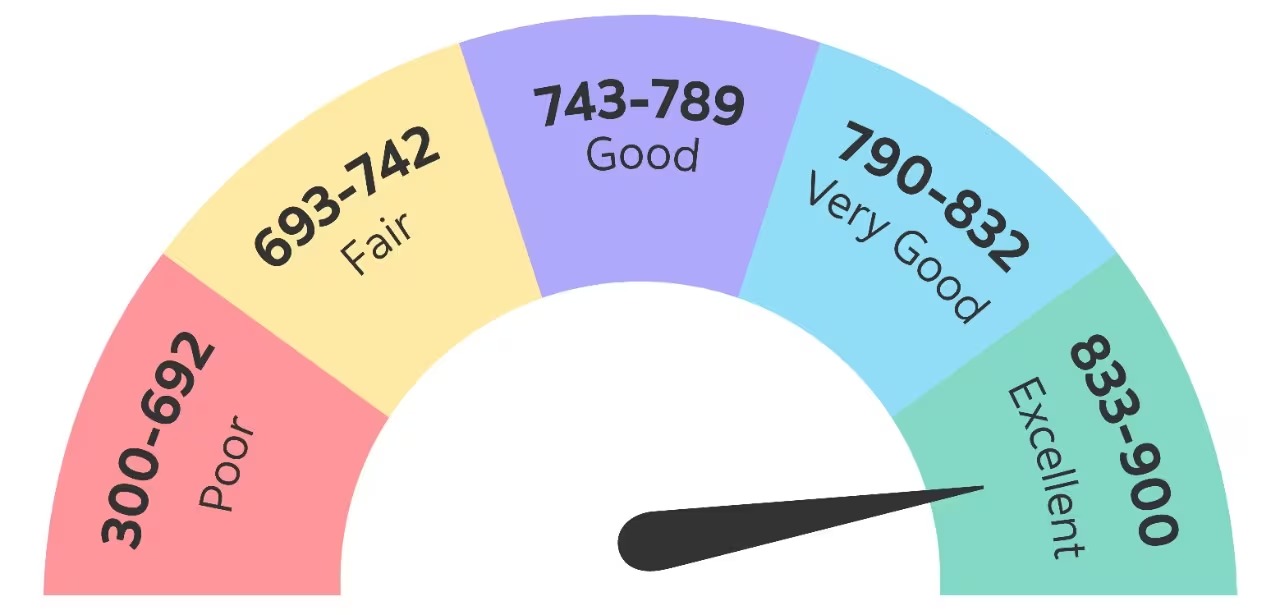

When a bank or lender requests your credit score, credit reporting agencies compute the score using a proprietary algorithm. While borrowers won’t know the exact score lenders are using, they can use their credit scores to understand generally how they appear to lenders, risk-wise.

Improve that risk equation by taking the following credit score improvement steps:

Pay Your Bills on Time

Fulfilling financial obligations by paying bills on time and in full each month shows lenders you have the ability to manage credit.

Build Your Credit History

Younger consumers looking to bolster their credit history can take several key steps. For starters, check with your landlord to report monthly rent payments to the three major credit bureaus. Additionally, leverage a low-interest card when making smaller purchases like a coffee and danish at Starbucks or by paying your dry-cleaning bill, then be sure to pay the credit card bill on time. To creditors and lenders, a crystal-clear history of on-time payments shows responsible borrowing habits and should boost a credit score.

Monitor Your Credit Utilization

Credit utilization, i.e., the amount of debt used out of all available credit, is one of the key components of your credit score. Lowering your credit utilization ratio (keeping the debt owed under 30% of the maximum credit limit is a good rule of thumb) can positively affect a credit score, because it indicates you’re managing your credit responsibly.